Bitcoin Fear and Greed Index

A sentiment analysis tool for Bitcoin and crypto markets, indicating when markets are overly fearful or greedy.

Data & charts updated every 5 minutes - Get 10 seconds

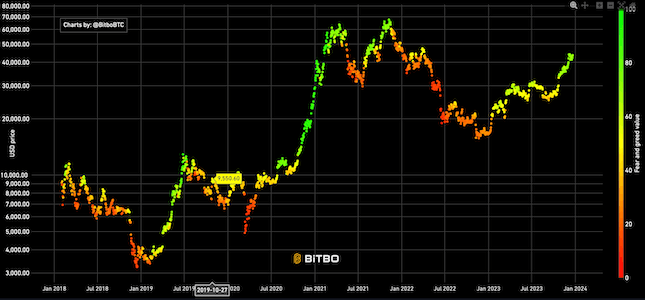

The Relative Strength Index (RSI) chart is a momentum based visualization for the Bitcoin market. We use the RSI to measure the speed as well as the magnitude of directional price movements in Bitcoin. Depending on how fast a price changes and by how much, an RSI score is given to the month being observed relative to the previous 12 months.

- A high RSI means that price movements are very positive relative to the previous 12 months.

- A low RSI means that price movements are very negative relative to the previous 12 months.

Essentially the RSI, when graphed, provides a visual mean to monitor both the current, as well as historical, strength and weakness of a particular market. The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes.

Each dot along the chart represents a month of time and its score is evaluated relative to the previous 12 months. Traditional usage of the RSI states that values of 70 or above indicate that a bitcoin is becoming overbought and may soon fall. An RSI reading of 30 or below indicates that bitcoin is oversold and may soon. You can see the RSI for each month by hovering over it with your cursor.

A sentiment analysis tool for Bitcoin and crypto markets, indicating when markets are overly fearful or greedy.

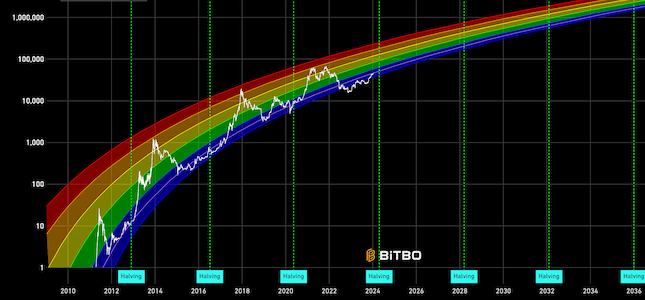

Bitcoin’s natural long-term power-law corridor of growth.

A Bitcoin rainbow chart using only the halving dates as data.